Ribbon-cutting ceremony marks UD’s entry to new FinTech Innovation Hub

Photos by Evan Krape and David Barczak October 06, 2023

The building already was open for business, having secured its Certificate of Occupancy more than a year ago.

But a brief ribbon-cutting ceremony on Wednesday, Oct. 4, outside the new, six-story FinTech Innovation Hub on the University of Delaware’s Science, Technology and Advanced Research (STAR) Campus marked an important milestone — the official entry of UD faculty, staff and students to this new financial technology ecosystem.

With economist Carlos Asarta and computer scientist Rudolf Eigenmann — from the Alfred Lerner College of Business and Economics and the College of Engineering, respectively — now serving as co-directors of UD’s fintech enterprise, exciting new collaborations and opportunities already are emerging.

“I’m elated that this building is becoming a reality,” said UD President Dennis Assanis. “It’s truly a dream come true.”

Assanis thanked Gov. John C. Carney Jr. and Delaware lawmakers for their support of the project. He thanked Matt Parks, a vice president of Discover Bank, which is a partner in the project, and Mike Bowman, president and CEO of the Delaware Technology Park, which owns the building.

“Fintech innovation is really the next chapter in the history that we all are writing together here on the STAR Campus,” Assanis said, “the next chapter in the treasured history of our university.

“What is really amazing about this gem is the fact that we already have collaborative hubs on the STAR Campus — in health and life sciences and with our partners in industry — in energy with Bloom Energy and materials, think Chemours,” he said. “Now we’re bringing another great play in our playbook here. The research and innovation at this new hub will expand Delaware’s legacy of national leadership in financial services. We’re also opening up new space for education.”

The excitement around this new headquarters of fintech innovation is grounded in the foundational objectives of the hub, which is designed to promote and enable collaborative work to improve equity in financial services and health, especially for low-income populations where access to high-quality services has been missing for many.

The Federal Deposit Insurance Corporation (FDIC) reported in 2021 that almost 6 million households in the United States had no checking account, no savings account and no credit line. Poor access to trustworthy financial services contributes to many other difficulties — including difficulty finding employment, obtaining insurance and building wealth.

“All of this perpetuates the cycle of poverty,” Assanis said. “But we can help fix that. We can develop the innovative fintech solutions to help those families get the affordable financial services that they need.

“It’s a huge challenge. But it’s one that we’re going to tackle right here in this building with help from all of you — our faculty, students and partners.”

The FinTech Hub already is about 95 percent full, Bowman said.

To read more see: https://www.udel.edu/udaily/2023/october/ribbon-cutting-fintech-innovation-hub/

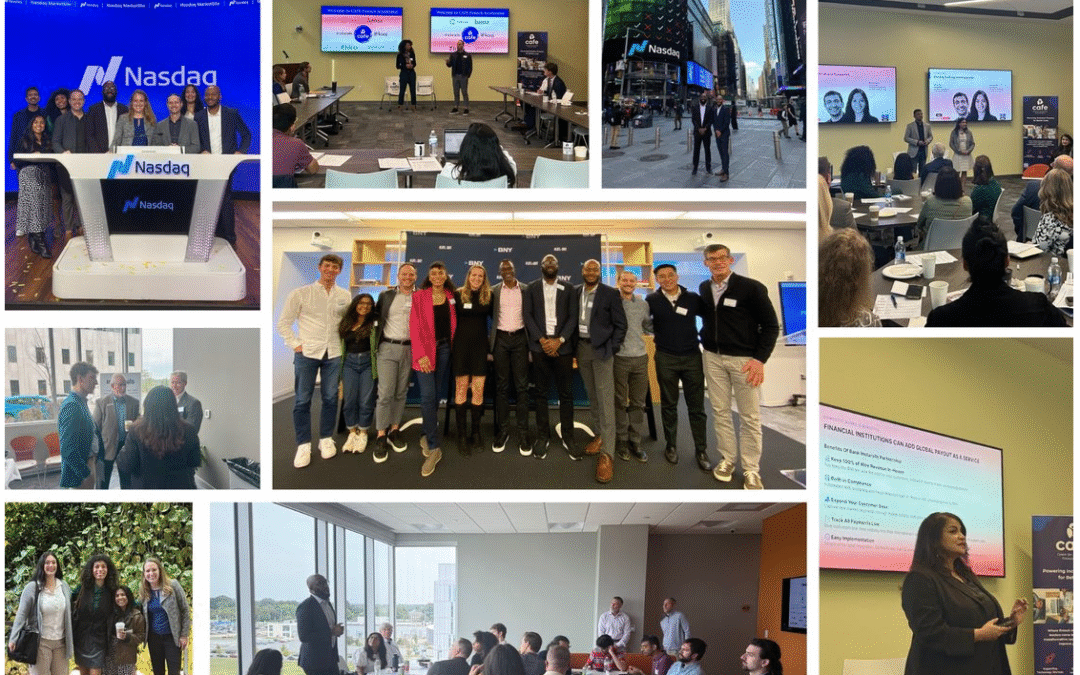

CAFE: Where Community Drives Acceleration

Real Growth. Real Community. Real Momentum. "I...

McBride, Gay, Mantzavinos Convene Delaware Leaders at American Fintech Council Policy Summit

WASHINGTON, D.C. — Yesterday, U.S....

Bridging the Gap: How Fintech is Enhancing Financial Equity

“It’s really important that they don’t stifle...