CAFE is Open: Announcing Our Inaugural Fintech Cohort

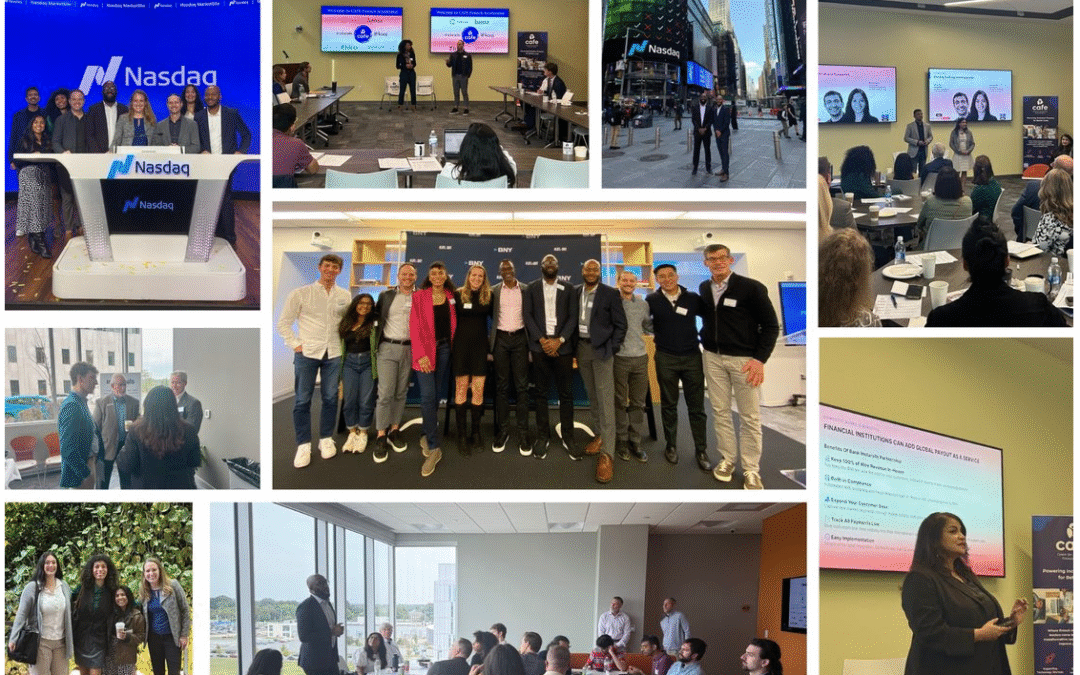

Newark, DE (Feb 27, 2024 )- The Center for Advancing Financial Equity (CAFE) announced its inaugural cohort of companies selected for its Fintech Accelerator Program. The non-profit accelerator aims to scale impact-driven early- to growth stage- financial technology companies that have products that work to improve the lives of underserved, underrepresented, and low-to-middle income (LMI) people and communities.

Finalists were chosen from across the US, following a rigorous selection process, based on the founding team, company’s mission, product validation and current market traction, future scalability, and potential impact.

The inaugural cohort includes:

Parlay: Works with community banks and credit unions to get more underserved small businesses approved for loans. Parlay is focused on veteran-owned, women-owned, immigrant-owned, and black- and brown-owned small businesses, who disproportionately struggle with affordable access to capital.

Stratyfy: Interpretable AI solutions enable financial institutions to make more accurate, efficient, and fair financial decisions in credit risk, fraud, and compliance. Stratyfy is on a mission to accelerate financial inclusion by providing greater transparency and less bias to critical financial decisions that impact millions of people.

Nester: The first-ever tool to help homebuyers and homeowners avoid their #1 regret: unexpected costs of repairs and maintenance. These costs disproportionately affect LMI members of our community who are at a greater risk of losing their homes as a result of an unexpected repair.

Wellthi: Helps people build wealth better together by equipping financial institutions with social community finance technology and payment solutions that foster financial health, credit readiness, and access to affordable capital directly through your mobile banking application.

Muse Tax: Helps individual taxpayers and SMBs extract data from tax returns, maximize refunds, and get personalized financial insights through an AI-based, tax and financial module. Muse’s mission is to equip LMI and underserved communities with expert financial assistance, without the prohibitive cost, because financial wellness is the way to build generational wealth and their future depends on it.

Sunny Day Fund: Powers workplace emergency savings programs for people-first employers shining the light on financial well-being. By automating and incentivizing savings for workers in sectors like hospitality, manufacturing, and healthcare, Sunny Day Fund removes barriers to banking and equitable wealth building.

The 10-week hybrid-virtual program will run from March 25th – June 1st where the accelerator companies will benefit through intensive growth-oriented curriculum, mentors, advisors, and speakers representing the wide range of stakeholders in financial equity, as well as ecosystem connections including financial institutions and banks, capital sources, and potential customers. Additionally, they will undergo coaching for real-world business growth, including selling to large regulated institutions, technology innovation, and regulatory compliance.

“We built this accelerator program intentionally and thoughtfully from the ground-up with the best of industry leaders, entrepreneurs, bankers, academia, and investors feedback and resources. Our non-profit ethos means we care about the people involved – especially the end users – as well as supporting the accelerator founders that are creating real solutions for financial and social impact.” said Kristen Castell, CAFE Managing Director.

CAFE’s program is unique in the accelerator space. “Solving the significant problems of financial inclusion and equity for low- and moderate-income populations is a significant societal challenge. CAFE’s mission is to empower private sector ventures leveraging financial technologies to create innovative solutions not previously possible,” said Charlie Horn, CEO of 5Lights, CAFE Chairman & Board President.

As a non-profit, CAFE seeks monetary and partnership support for the accelerator program and overall financial inclusion mission. Companies pay no fee to participate in the accelerator, and CAFE does not take an equity stake nor invest in the companies.

CAFE is part of the Fintech Innovation Hub in Newark, Delaware, and was established to address inequities in access to affordable, safe, and high-quality financial services. “FinTech Innovation Hub is the result of a five-year journey between Delaware Technology Park, Discover and the University of Delaware. The mission – tackle issues that impede financial equity for vulnerable populations. The pinnacle of this undertaking is the CAFE Accelerator. It is an exciting endeavor to help progress selected companies to commercialize their products and showcase them to investors,” says Mike Bowman, CEO of Delaware Tech Park.

About CAFE

CAFE is a non-profit 501(c)(3) organization that advances financial health & wellness for low- to moderate- income (LMI) and other underserved communities through fintech innovation and partnerships. The inaugural accelerator program is a flagship offering of CAFE. CAFE was launched in part by funding from the Small Business Association (SBA).

Learn more about CAFE at www.ftcafe.org.

Press and partnership inquiries, contact Managing Director Kristen Castell at kristen@ftcafe.org.

Technical.ly Article about the announcement: https://technical.ly/startups/cafe-fintech-accelerator-delaware-dc-nyc/

###

CAFE: Where Community Drives Acceleration

Real Growth. Real Community. Real Momentum. "I...

McBride, Gay, Mantzavinos Convene Delaware Leaders at American Fintech Council Policy Summit

WASHINGTON, D.C. — Yesterday, U.S....

Bridging the Gap: How Fintech is Enhancing Financial Equity

“It’s really important that they don’t stifle...