CAFE Demo Day Fintech Showcase

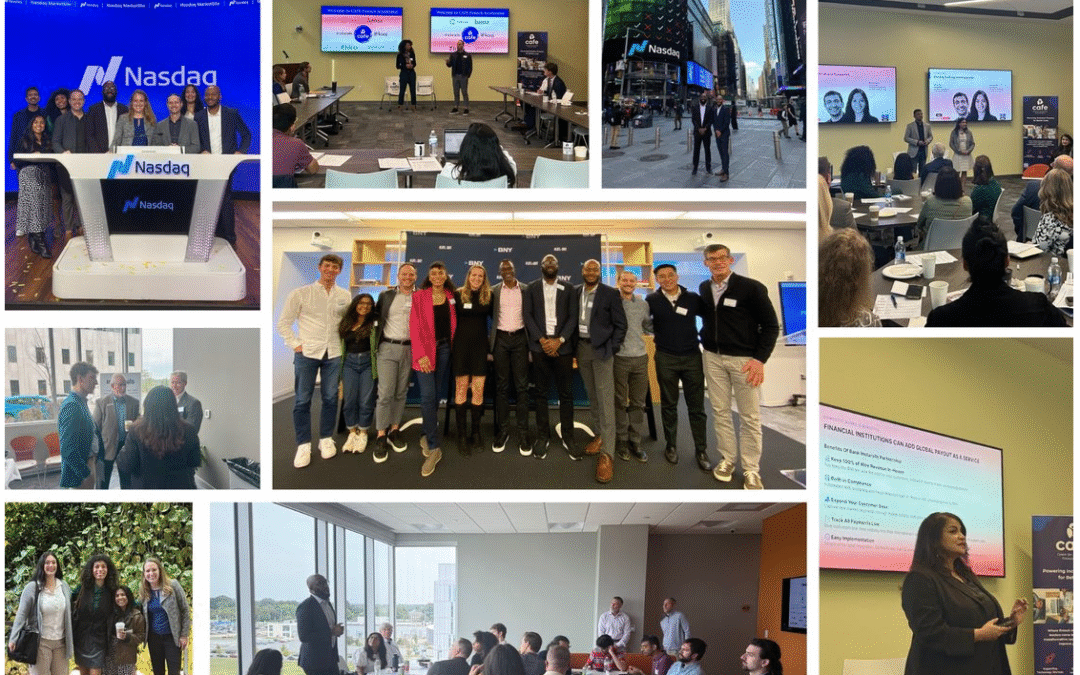

After an unforgettable 10-week journey filled with insightful speakers, dedicated mentors, company pitches, and customer and investor networking opportunities, CAFE’s inaugural fintech accelerator program has come to a successful conclusion. This accelerator program was specifically designed to scale impact-driven fintech companies with market-ready products that aim to improve the lives of low- to middle-income (LMI) individuals and underserved communities. Our first cohort featured six extraordinary companies: Stratyfy, Muse, Nester, Sunny Day Fund, Parlay, and Wellthi. Each of these companies has demonstrated a remarkable commitment to innovation and social impact, embodying the mission of our accelerator program.

Our end of program Demo Day was held on May 30th at the Fintech Innovation Hub on the University of Delaware’s Science Technology and Advanced Research (STAR) campus. The event brought together a diverse group of guests from banking, government, academia, and other sectors to witness innovative pitches from each of the fintech companies.

The day kicked off with ample networking opportunities, allowing our companies and attendees to connect and share insights. Following this, each of our participating companies delivered compelling pitches showcasing their groundbreaking fintech solutions to our attendees. Additional opportunities for networking and connection continued following the conclusion of pitches.

CAFE Accelerator Highlights

Our accelerator is an equity-free program at no-cost to fintech companies designed to support and scale “real world” innovations by nurturing revolutionary businesses. We focus on startups that create technologies with a mission to level the financial playing field. By collaborating with financial institutions, investors, and various partner organizations, we connect cutting-edge fintech solutions to communities in innovative ways. We connect founders with bankers, investors, and other organizations for customers, talent, partnerships, and funding.

Startups in the CAFE Fintech Accelerator Program benefit from expert mentorship in client-centric sales, including pitching, storytelling, and selling into financial institutions, as well as forming strategic partnerships.The program also offers comprehensive insights into financing for growth, covering valuations, financial forecasting, venture capital, and CDFIs. Additionally, our startups receive essential guidance on legal matters and cybersecurity to ensure long-term stability and growth.

Participants attended both in-person and virtual sessions to complete the 10-week hybrid program. Our program features a diverse array of speakers and mentors. Industry experts provided a wealth of knowledge for our companies in their specific areas of expertise. Wendy Heilbut covered legal topics for growing companies, highlighting fundraising, intellectual property, and customer engagement. Katie Dunn offered insights on pitching for funding. Maryclare Walsh focused on partnerships, sales processes, and brand awareness. Nirbhay Kumar shared his expertise on the buying process, due diligence, contracts, and selling into regulated financial institutions. Jeff Mitchell and Kevin Cunningham provided advice on financial forecasting and valuation. Vikas Raj and Bryson Hearne discussed company valuation from the VC perspective, while Tasha Parker gave an overview of CDFI loan options for small businesses. Jennifer Halweil shared the art of effective storytelling and Jake Blacksten emphasized the importance of cybersecurity tactics for company protection.

Other notable mentors included author and speaker Theo Lau, who delivered a “Beyond Good” keynote speech and Mark Ferguson CEO and founder of Innervation Finance. Jamie Scott Berniker shared wisdom on selling to Financial Institutions, and BlackRock’s Ila Eckhoff, who provided advice on team dynamics, culture, and processes within organizations.

Companies also had the opportunity to attend sessions with venture capital firms, including Chartline VC (Discover Fund), Resilience VC, Cohen Circle, and Laconia. They also engaged with banks through the American Bankers Association (ABA), Bank of New York Mellon, Independent Community Bankers of America (ICBA) and the Delaware Banker’s Association as part of the curriculum. Additionally, they worked with UD Data Science Institute engineers to work on AI and machine learning projects.

In addition to virtual sessions, our companies participated in various events such as NYC Fintech Week and Cohen Circle & CAFE Inclusive Fintech Event at Barclay’s Rise in New York City. They were connected to the regulatory environment with American Fintech Council meetings with the CFPB in Washington, D.C., and showcased their innovations during Demo Day at the Fintech Innovation Hub.

Sponsors of CAFE’s Spring 2024 Cohort

Below is a list of some of our key sponsors of the CAFE Fintech Accelerator Program who have been instrumental in helping us offer this equity-free program at no-cost to fintechs. With their support, along with our other partners, we are furthering CAFE’s mission of transforming the financial system to be more inclusive for all.

American Bankers Association: ABA is a banking trade association of community, regional, and money center banks, holding companies, savings associations, trust companies, and savings banks.

Delaware Prosperity Partnership: DPP leads Delaware’s economic development efforts to attract, grow and retain businesses and build a stronger entrepreneurial and innovation ecosystem.

Delaware Technology Park: DTP is a recognized leading East Coast non-profit research park with a mission to stimulate economic growth and create high-value jobs in the Mid-Atlantic region by providing affordable state-of-the-art facilities, access to necessary resources and connections to the region’s industry, government and academic leaders.

Discover Financial: is a digital banking and payment services company with one of the most recognized brands in U.S. financial services.

Genius Avenue: powers the insurance and benefits industry with custom capabilities and innovative, customer-centric platform solutions that connect products to consumers and increase the bottom line.

Heilbut LLP: provides legal solutions and guidance to high-growth companies: bridging the gap between traditional legal service and strategic advice, specializing in novel intellectual property offerings, complex corporate negotiations, and innovative business developments.

Siegfried Advisory: financial and tax advisory firm that works with transformative leaders in growth-oriented organizations to build and maintain a healthy, scalable finance and accounting function.

XYZ Power Capital: data scientists and software engineers who build innovative and insightful machine learning solutions for investment management. We strive to seize opportunities in this ever-changing and turbulent investment landscape.

CAFE: Where Community Drives Acceleration

Real Growth. Real Community. Real Momentum. "I...

McBride, Gay, Mantzavinos Convene Delaware Leaders at American Fintech Council Policy Summit

WASHINGTON, D.C. — Yesterday, U.S....

Bridging the Gap: How Fintech is Enhancing Financial Equity

“It’s really important that they don’t stifle...