Digital Identity Systems: A Crucial Conversation on Trust, Innovation, and Inclusion

Presented by the Center for Accelerating Financial Equity (CAFE) in partnership with the National Alliance for Financial Literacy and Inclusion (NAFLI)

As financial systems grow more digital and interconnected, the need for robust, inclusive, and privacy-conscious digital identity systems has never been more pressing. In a recent virtual panel hosted by the Center for Accelerating Financial Equity (CAFE) and NAFLI, thought leaders from fintech, policy, and nonprofit sectors gathered to explore the technical, regulatory, and human dimensions of digital identity systems in financial services.

Setting the Stage: Why Digital Identity Now?

The session, moderated by our Managing Director Kristen Castell, framed digital identity not just as a technical necessity, but a foundational piece in advancing financial equity. With a focus on serving low- to moderate-income communities, Castell emphasized how fintech innovation, when responsibly implemented, can transform lives but only if identity systems are built with trust and inclusion at their core.

“We’re focused on helping financial technology solutions scale responsibly,” said Castell. “That means bringing together banks, credit unions, investors, regulators, and most importantly the people who use these products.”

Meet the Experts: A Cross Sector Dialogue

The panel featured three leaders deeply embedded in the evolving digital identity landscape:

- Amanda Estiverne, Board Member of NAFLI, has over 20 years of experience in financial services, with a strong focus on inclusive product design. She emphasized NAFLI’s role in driving forward-thinking policy and ensuring that consumer voices remain central in product development.

- Martha Underwood, CEO and Founder of Prismm, shared insights into legacy challenges in wealth transfer systems. Her company helps financial institutions retain deposits by streamlining how assets are transferred from account holders to their beneficiaries a use case that heavily relies on trusted identity verification.

- Elizabeth Garber, fintech entrepreneur and advisor, now works with global nonprofits and standards organizations. Her work spans groups like the OpenID Foundation, CityHub, and the UN’s DPI Safeguards, all of which focus on building secure, interoperable, and rights-enhancing digital identity frameworks particularly in developing countries.

A Multi-Dimensional Discussion: Trust, Policy, and People

The 45-minute event was broken into thematic sections that reflected the depth and complexity of digital identity systems:

- Landscape and Challenges – Panelists shared insights on the fragmented nature of identity infrastructure, the lack of interoperability across platforms, and the challenge of balancing user security with accessibility.

- Policy and Regulation – There was a consensus that digital identity can’t scale responsibly without clear regulatory guidance. Governments, financial institutions, and technologists must collaborate on frameworks that protect users while allowing innovation.

- The Human Element – Perhaps the most critical theme was inclusion. As Garber noted, identity systems often reflect existing societal inequities. Ensuring they are designed with marginalized populations in mind is not just ethical, but essential for financial equity.

- Innovation and the Road Ahead – From emerging standards in identity verification to secure APIs that can connect institutions globally, the panelists discussed promising paths forward. But each stressed that technology alone is not the answer community trust, policy coordination, and human centered design must lead.

Looking Forward

This event marks an important milestone in the ongoing conversation around digital identity for financial equity. It brought together voices from across the spectrum technologists, entrepreneurs, policy experts with a unified goal: to build systems that are trustworthy, scalable, and inclusive.

“Digital identity is about more than access,” said Castell. “It’s about dignity, safety, and the ability to participate fully in financial life.”

The future of work in Delaware

Backing innovation and strengthening our...

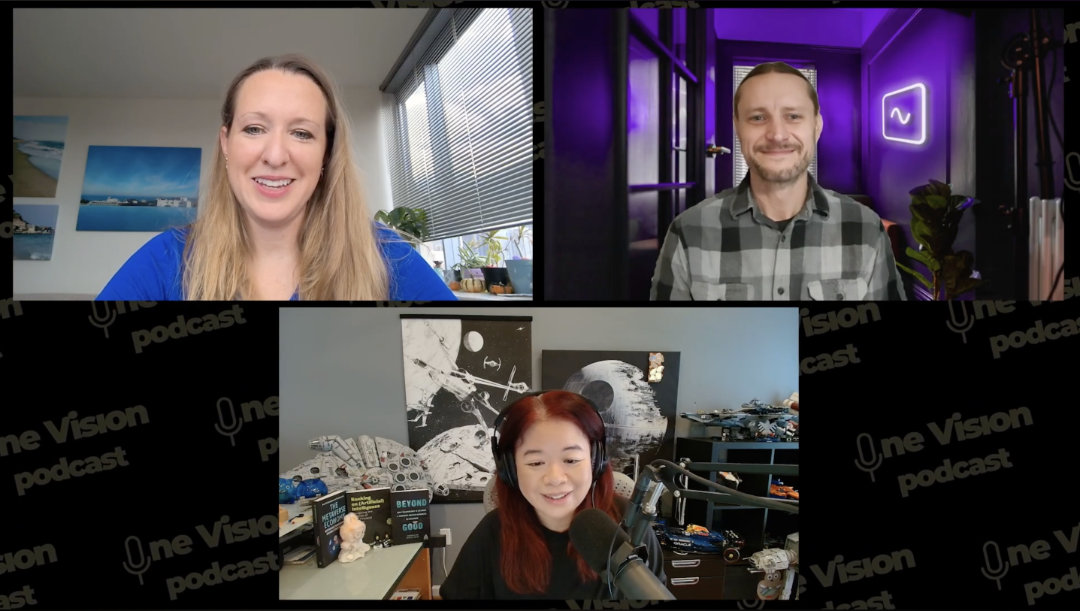

CAFE Leaders Featured on One Vision Podcast to Discuss Financial Equity, Founder Collaboration, and the Future of Fintech

The One Vision Podcast has released a new...

Press Release Dec 2, 2025: IgniteFI and CAFE Partner to Empower Fintechs Serving Credit Unions

IgniteFI, a leading fintech advisory firm...