CAFE’s Fintech Accelerator Is Fueling Financial Equity and Innovation in Delaware

NEWARK — Martha Underwood took an idea born out of an upsetting period in her life and turned it into a financial technology company, thanks to the Center for Advancing Financial Equity, or CAFE for short.

Eight years ago, her father fell from a neighbor’s roof while helping clear downed tree branches in Birmingham, Ala. After he was taken to the hospital, Underwood was called by her mother to help answer questions about a health directive and insurance.

“We’re hearing all the commotion going on in the background, and I’m thinking, ‘What if the worst happens? Do we know where Dad’s assets are?’” she said. “He made a full recovery, but that was a wake-up call for me to have a mechanism to access this information if something happens.”

From that point, Prismm was born. As a retail software engineering executive who started her career at IBM, Underwood knew that there were gaps in banks when it came to critical assets. Prismm is a digital vault that can hold documents, property and assets in an encrypted account. The data is encrypted when it’s in transit to banks or resting in the program, so no one can see it without authorization.

The account owner can view and modify all data, and permissions can be granted to financial advisors, lawyers or other trusted family members. The whole goal is to give peace of mind for the younger generation to handle estates of loved ones or medical emergencies.

“From a strategic perspective, banks want more accounts, but they’re letting money walk out the door without capturing that beneficiary as a potential client of the bank. And for the next generation, you’re making it easy for them to access that information in one spot,” Underwood said.

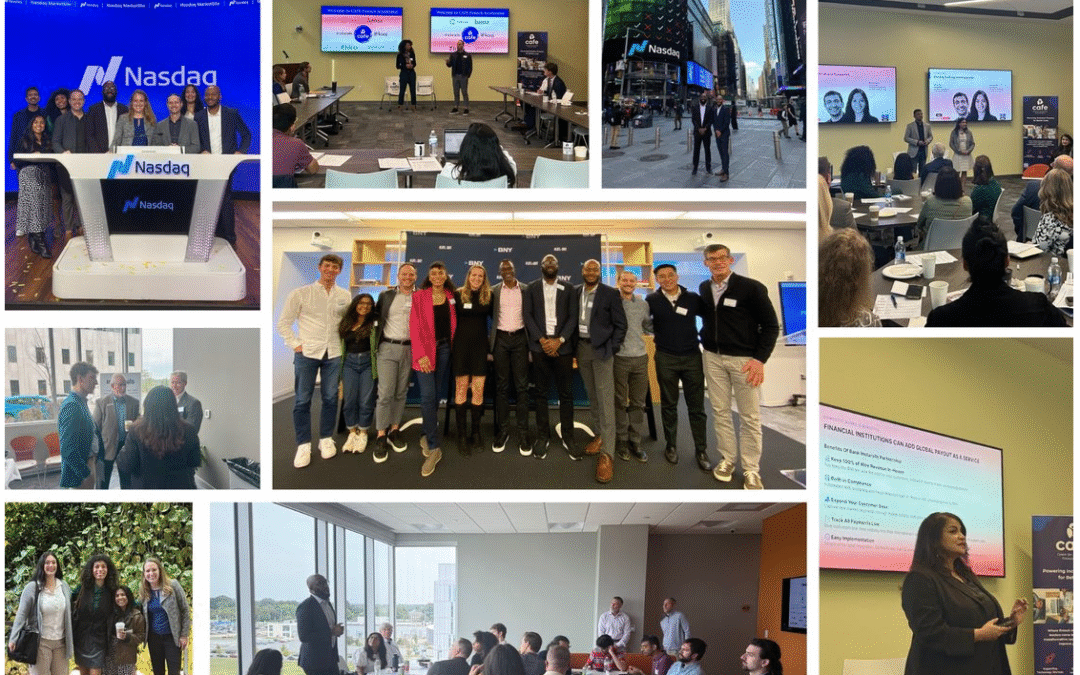

Underwood was one of 18 entrepreneurs that participated in a 12-week accelerator program at the Center for Advancing Financial Equity (CAFE), inside the FinTech Innovation Hub at University of Delaware Star Campus. The accelerator program brings in early-stage companies that focus on products that address financial wellness for low-to-middle income communities.

The CAFE accelerator program, launched last fall, is broken into two cohorts per year, and it’s expected to launch in September. The program helps connect startup founders with various professional groups, like the American Bankers Association, the U.S. Small Business Administration and the American FinTech Council.

Each participating entrepreneur flies in at the beginning of the program for a “launch day” where they meet industry exports on sessions ranging from elevator pitches to risk compliance. The day ends with a pitch showcase. At the end of the program, the startup companies will demonstrate their product to banking representatives.

“It’s not like your average accelerator where you’re sitting in a lecture, it’s actually putting you in a situation where you’re able to talk to potential customers or partners,” Underwood said. “That’s what makes it so valuable.”

For CAFE Executive Director Kristen Castell, the accelerator was just one of the exciting programs at work inside. The nonprofit looks to advance financial health for 70% of the population that are financially vulnerable by growing new startups like Prismm through connections with financial institutions and technology.

It’s not only about launching companies, but building an ecosystem to attract and retain the next generation of companies. With CAFE being stationed at UD’s STAR Campus, it has a chance to bring in academics, investors, banks and industry leaders in support services like accountants and attorneys in one spot. That combination, Castell hopes, would build a better financial future.

“The technologies we’re building and the companies that we’re supporting are good for business and are the future of finance. It’s the dual message at CAFE that it’s not only good for people’s livelihoods, but it’s a good investment for businesses,” Castell said.

When CAFE started two years ago, it brought on vetted fintech and financial companies, including those with a local presence like M&T Bank and Best Egg. That helps the CAFE team to understand what issues today’s companies and clients are facing and how to solve them in innovative ways that could integrate in their existing work.

That philosophy has helped grow the programming at CAFE. This summer, it hosted a fintech conference that brought stakeholders together at the Dupont Country Club.

When it comes to the startup companies themselves, there’s a lot of promise. Past cohort members include Nester, a tool that helps homebuyers estimate expenses over the next 15 years, and Sunny Day Fund, which helps automate and incentivize savings for workers.

For Underwood, her experience at CAFE has opened the door to the possibility of relocating the company from her native Birmingham to Delaware to take Prisimm to the next level.

“Delaware has such a large concentration of trust companies, which is one of our adjacent targets, as well as its history in the banking space there. That and its proximity to New York and D.C. and the support there really makes a difference,” she said.

The CAFE Fall Accelerator is open for applications until August 13. The program will launch on Sept. 29 for two months. To apply, visit ftcafe.org/apply.

CAFE: Where Community Drives Acceleration

Real Growth. Real Community. Real Momentum. "I...

McBride, Gay, Mantzavinos Convene Delaware Leaders at American Fintech Council Policy Summit

WASHINGTON, D.C. — Yesterday, U.S....

Bridging the Gap: How Fintech is Enhancing Financial Equity

“It’s really important that they don’t stifle...