As is so often the case in Delaware, the inception of the Delaware Technology Park (DTP) came down to collaboration. “DTP was a trifecta between the university, the state and the private sector, created 25-plus years ago,” says Mike Bowman, DTP’s president and CEO.

In 2016, DTP’s footprint expanded with DTP@STAR, an incubator on the University of Delaware’s (UD) 272-acre Science, Technology and Advanced Research (STAR) Campus. DTP is widely renowned as one of the leading nonprofit research parks on the East Coast and its footprint is soon set to expand again with a new building that will be known as 6 Innovation Way.

That building — DTP’s sixth — on the eastern edge of the UD campus will comprise three stories and 90,000 square feet. It aims to become a hub for life science and research companies, as well as potentially providing wet-lab space for commercial spinouts from the university.

DTP serves development-stage life science, information technology, advanced materials, financial technology (fintech) and renewable energy companies, providing them with access to the resources and connections needed to drive and accelerate their economic success.

“Since 2016, the DTP@STAR Incubator has seen 25 companies start there and then grow back out larger to the community,” Bowman says.

FinTech Innovation Hub

DTP is the developer, owner and operator of the six-story FinTech Innovation Hub on the STAR Campus, in partnership with University of Delaware and Discover Bank. The building opened in 2023 and is 95% occupied.

The Hub’s work includes research, education, workforce development, venture creation and support, as well as innovation in the technological advances that support financial products and services. UD occupies 50% of the building with the Colleges of Engineering and Business and the remainder is leased by nonprofits, entrepreneurs of small businesses, the Growth Stage Incubator, a restaurant and conference facilities. The FinTech Innovation Hub’s mission is to help low- to moderate-income populations achieve financial well-being and grow the financial services sector in Delaware.

It also draws on UD’s FinTech Consortium of experts in data science, artificial intelligence and machine learning — along with its Center for Cybersecurity, Assurance & Privacy and AI Institute — to create innovative and safe financial programs. Nektarios Tsoutsos, an expert in cybersecurity in the College of Engineering, and Gang Wang, an expert in the adoption of digital technologies and their societal impact in the Alfred Lerner College of Business and Economics, direct UD’s fintech ecosystem.

“Our work at the Hub is innovative because of its focus on integrating advanced technologies like homomorphic encryption and mobile ID technology with societal impact,” Tsoutsos says. “These innovations are not just technical achievements; they directly address critical issues like financial inclusion and security, particularly for underserved communities. By combining expertise across disciplines, like cybersecurity, data science and public policy, we’re pioneering solutions that make financial services more accessible and secure.”

Wang notes that a particularly innovative aspect of his work is “exploring how firms and individuals adopt digital technologies, such as AI, in evolving regulatory environments. By combining behavioral insights with empirical data, I uncover patterns that help policymakers and businesses navigate the balance between innovation and regulation. This approach not only informs smarter policy design but also fosters a more inclusive and efficient digital economy.”

“Delaware’s rich history as a leader in financial services, coupled with the cutting-edge resources at the University of Delaware’s STAR Campus, creates the perfect environment for fintech innovation,” Tsoutsos says.

Wang calls it “an ideal place to explore how emerging technologies reshape finance and business. Being here allows me to bridge academia, industry and policymakers to drive meaningful impact.”

Center for Accelerating Financial Equity

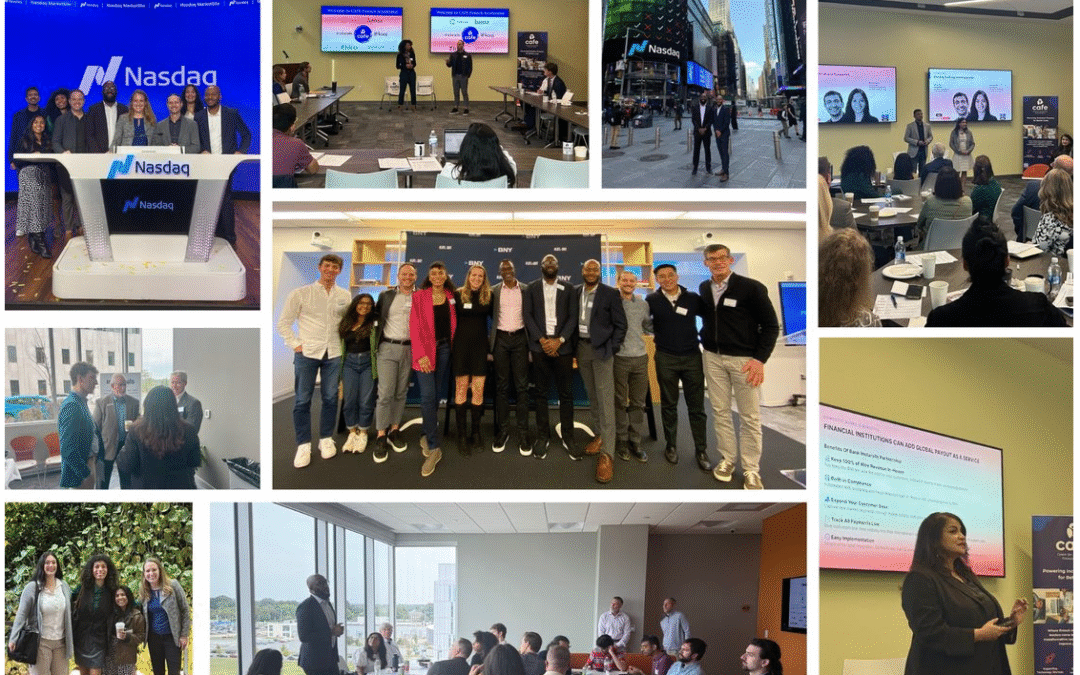

A cornerstone of the FinTech Innovation Hub is the Center for Accelerating Financial Equity, or CAFE, a leader in the development of inclusive finance.

Innovators in fintech and financial institutions work together to find solutions that help low- to moderate- income individuals — about 70% of the population, Bowman says — build financial health and wellness. CAFE is a place where startup founders with this mission in mind can access the expertise, partnerships and resources to grow and scale their business.

CAFE’s location at the Hub allows it to collaborate with others in this ecosystem of academic, business and technical innovation. Launched two years ago, CAFE started with the idea, “how do we build financial inclusion?” says Kristen Castell, CAFE’s managing director.

The center sponsored two cohorts of six companies for 10 weeks each last year. “We bring in financial institutions, investors like venture capitalists, industry associations, academia and regulators, and we introduce them to these companies’ founders,” Castell explains.

Bowman says that CAFÉ received 78 applications from across the U.S. for those six spots. “All have customers and revenue, so they are not brand new,” he says. “They are looking to scale their company and get in front of bankers and investors.”

For example, a company called Nester created a digital platform that helps those buying a home estimate their expenses over the next 15 years. This can help users make smart decisions so they can avoid incurring added debt, stay in their homes and build wealth. Another startup, called Parlay Finance, created a platform to help small businesses navigate the loan process and get approved for Small Business Administration (SBA) loans. And Prismm, a company based in Alabama but planning to move to Delaware, has a platform for generational wealth transfer. Users can upload all their financial documents into a digital “vault,” like a safety deposit box, and then invite other family members into it. “It makes sharing wealth easier,” Castell says. “Delaware is a center of trusts, so it makes sense for this technology” to be located here.

She says that CAFE is expanding beyond its accelerator program to offer other programs and thought leadership to support more companies. Castell came to CAFÉ with a long history of working in traditional corporate finance and fintech entrepreneurship. “I was looking for an opportunity to support and grow startup companies and also very passionate about financial inclusion and social impact,” she says. “This was my dream opportunity to build this from scratch.”

The Growth Stage Incubator

CAFE works closely with another community to support local businesses: the Growth Stage Incubator, under the direction of Pedro Moore.

“It’s not just a coworking space, but a growth community,” Bowman says.

It has 12 offices and coworking spaces, conference rooms and an event space. “Pedro Moore, a former venture capitalist, is also a coach. He helps businesses connect to money or partnerships,” Bowman says.

Companies can join at one of three different levels of membership: get an office, just use the coworking space or “just be a member with no specific room, but they can be in the mix here,” he says. Memberships are highly subsidized by DTP. “All of these are early-stage [companies], a year to a year-and-a-half. There is a lot of connectivity between CAFE and Growth Stage.”

The bottom line, according to Bowman: “Our intention is to build a center of excellence where all this stuff comes together.”

CAFE: Where Community Drives Acceleration

Real Growth. Real Community. Real Momentum. "I...

McBride, Gay, Mantzavinos Convene Delaware Leaders at American Fintech Council Policy Summit

WASHINGTON, D.C. — Yesterday, U.S....

Bridging the Gap: How Fintech is Enhancing Financial Equity

“It’s really important that they don’t stifle...